The federal government can strengthen US competitiveness in critical industries such as low-carbon steel, cement, chemicals, and aluminum by designing and implementing a contracts for difference policy to provide a way for manufacturers to de-risk their innovations.

A promising financial tool is spurring industrial innovation abroad. To drive growth in industries such as low-carbon steel, cement, chemicals, and aluminum, several countries in recent years have begun using contracts for difference policies.

Without greater federal support to advance domestic competitiveness, American manufacturing is at risk of falling behind in global markets that value energy-efficient, low-carbon industrial production. Contracts for difference could be an efficient tool for providing this support. However, to date, there is little experience in the United States with contracts for difference policy.

A group of experts across fields and organizations came together to write a report, published by the American Council for an Energy-Efficient Economy today, that explores the potential of a US contracts for difference policy. It evaluates contracts for difference as a policy tool to boost innovation and low-carbon American manufacturing and outlines design considerations for policymakers. Our coauthors on the report are Seton Stiebert, Yuqi Zhu, William Shobe, Benjamin Longstreth, Aaron Bergman, and Chris Bataille.

Contracts for difference lower the risk of capital-intensive projects by providing price certainty.

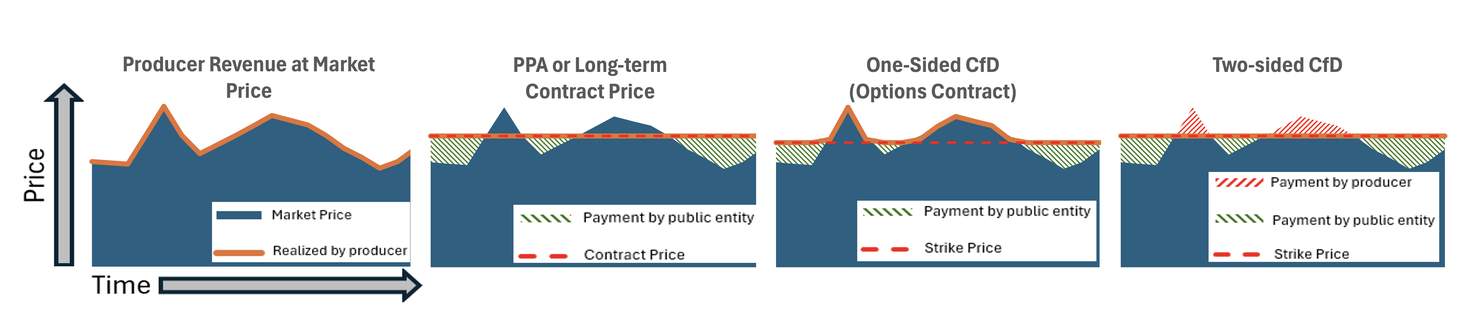

In the context of industrial decarbonization, a contract for difference is a contract in which a manufacturer and a government agree on a guaranteed price—the strike price—over a given period for low-carbon products or materials for which the government seeks to increase production. The government agrees to pay the manufacturer the difference between the strike price and the market price. Unlike a long-term contract or power purchase agreement, however, the government does not procure the product or material; it simply provides the financial boost for innovation in the market.

For example, suppose a low-carbon steel mill has a contract for difference guaranteeing $600 per ton and the market price drops to $550 per ton for a given period. In this case, the producer receives an additional $50 per ton from the government for that period. In some cases, contracts for difference also require the producer to pay the government the difference if the market price rises above the strike price (as Figure 1 illustrates, this depends on whether the contract is designed to be one- or two-sided). The strike price is usually determined through a competitive auction in which the government awards the contracts to eligible projects with the lowest-cost bids.

Figure 1. Payment and strike price options (Adopted from Beiter et al. 2023)

Similar contracts have been applied since the 1970s to a wide range of markets. They are widely used today in Europe to increase market uptake of clean electricity technologies. Germany and the Netherlands lead in using such contracts for low-carbon manufacturing. The price guarantee in these contexts sometimes focuses on the value of verifiable carbon emission reduction rather than the value of a unit of the produced good or material.

Contracts for difference are one key tool in the toolbox to support industrial innovation.

Contracts for difference are one powerful option among many strategies to support technological innovation and capital investment in low-carbon production. Tax credits, green procurement, advance market commitments, carbon taxes, and tradable performance standards are other policies that hold promise for spurring low-carbon production. The strengths of contracts for difference include their ability to:

- Attract private investment and lower the cost of capital by reducing risk. This is because of the price guarantee.

- Minimize the chance of over- or under-subsidization. The auction process rewards competitive, low-cost bids, allowing the government to minimize the subsidy needed to make a project economically viable.

- Conserve public funds. In addition to minimizing the chance of over-subsidization, the government may receive payments when market prices are high, in the case of two-sided contracts.

What would it take for the United States to start a contracts for difference program?

As a first step, policymakers can examine whether there is authority to create a contracts for difference program under existing federal law. The most straightforward path, however, may be for Congress to enact federal legislation authorizing such a program.

Our report details the program elements that policymakers must consider, such as eligibility requirements, auction design, and the adjustability of the strike price, among others. It also compares contracts for difference to other policy options. While the program’s overall impact would depend heavily on its scope and the level of government investment, an ambitious, well-designed program could help jumpstart American innovation and put domestic manufacturers on a better path to compete and lead globally in industries central to the transition to a low-carbon economy.

Note: This blog post was also published on the American Council for an Energy-Efficient Economy’s website.