New techniques for lithium extraction could mean an economic boom is coming to southwest Arkansas. Landowners and county coffers will likely benefit the most, though benefits could vary widely.

Southwest Arkansas was a booming oil hub in the 1920s and more recently made a name for itself in bromine extraction. But now, in the region’s oil fields, a new opportunity to extract resources has emerged: mining lithium from underground brines through direct lithium extraction (DLE).

DLE is an emerging technique that could efficiently and quickly extract lithium from underground brines. Given the increasing global demand for lithium, the region’s untapped wealth of the mineral could provide a powerful boost to the rural area’s local economy—not just by expanding local employment and skills training, but also by providing tax revenues for state and local governments to support schools, roads, and other services. People who own land used for DLE will also benefit directly from royalty payments.

The amount of taxes and royalties collected from the lithium industry in southwest Arkansas would depend on factors including the tax and royalty rates imposed on the industry, company profits, and volumes of production. Importantly, the extent to which DLE could provide a robust and extended tax resource base will depend on how the industry performs.

The challenge is that DLE is a complex chemical process that has not been proven at commercial scale, mainly due to differences in the chemical composition of brines across locations, often requiring location-specific techniques to extract lithium. DLE processes thus have been demonstrated mainly through pilot projects; whether project capital and operational expenses, extraction efficiency, and other outcomes will remain consistent once commercialized is yet to be seen. Furthermore, lithium prices have been extremely volatile over the past five years and sat at a multiyear low over the summer of 2025.

These challenges raise uncertainties that could directly affect collected taxes; for example, how efficient will the extraction process actually be? How much lithium could be recovered? How profitable will the companies be, especially if lithium prices do not recover?

To answer these questions, we conducted an analysis to demonstrate the range of funds that could be collected at the local, county, and state level, given a variety of uncertainties related to DLE technology. Using a project finance model developed in-house, and with data taken from publicly available feasibility and project studies from four companies aiming to invest in DLE operations in the region, we find that Lafayette, Union, and Columbia Counties in southwest Arkansas could expand their yearly budgets by around 15 percent, though that amount could drop to zero under unfavorable conditions. However, the real winners are the landowners, taking home almost double what a county acquires from DLE.

Taxes and Royalties

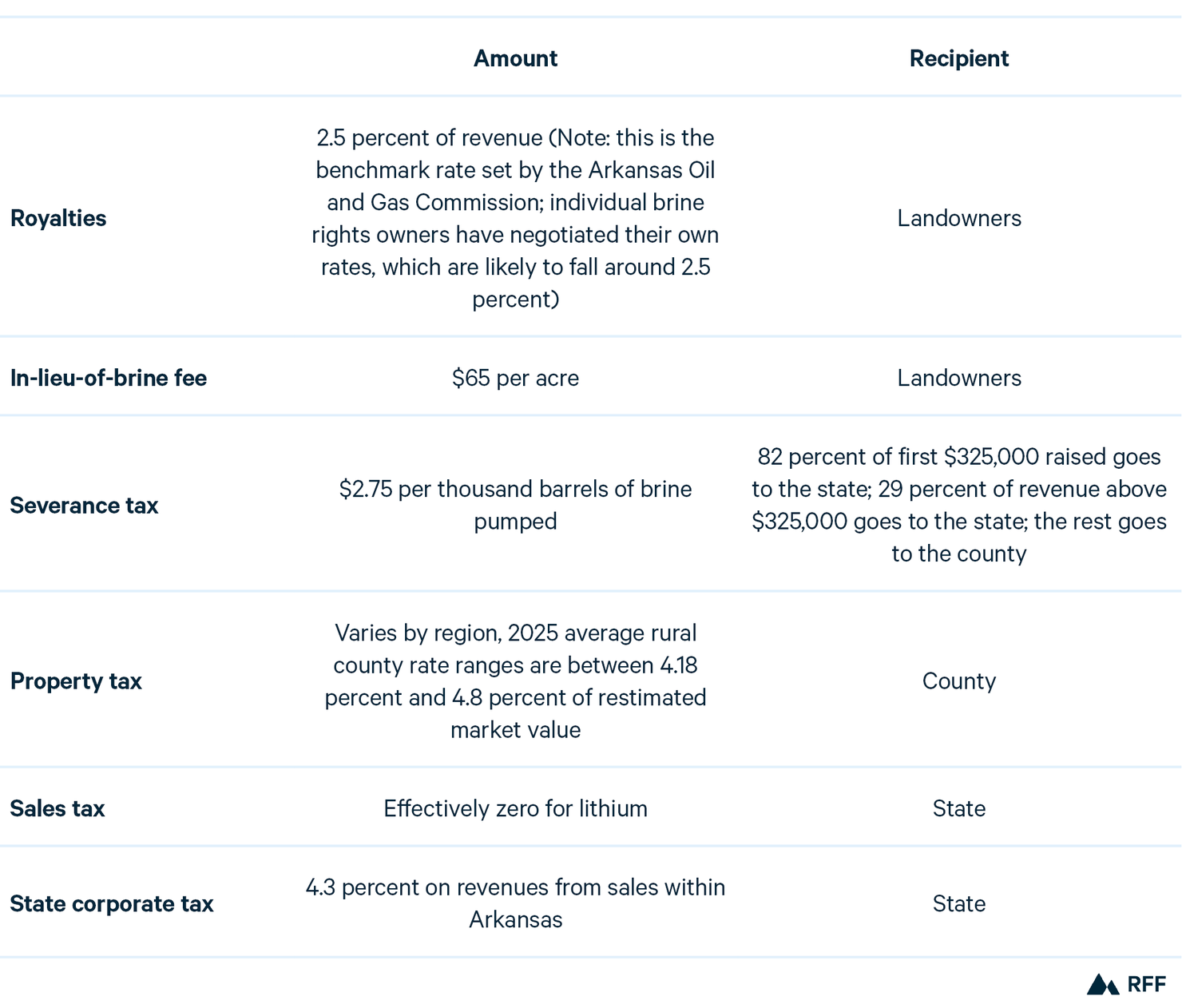

Companies in Arkansas are subject to various taxes and must pay royalties to the owners of land on which they conduct their activities (Table 1).

Table 1. Taxes and Royalties Collected

Though royalties have been set for only two of the companies in the region so far, this rate of 2.5 percent is likely to hold for the three other companies we analyzed, given the precedent set by Standard Lithium, the first company to set a rate with landowners in Arkansas. We also note that the state collects corporate taxes only on revenues from sales within Arkansas. As we are not sure how much of the extracted lithium will stay in state, we utilize this value as an upper bound to our analysis.

Funds Collected Under Expected Assumptions

To estimate funds collected from lithium extraction, we need to know more about each company’s revenues (which will depend on the lithium price and amount of lithium extracted), the amount of brine pumped, the market value of the companies, and the profitability of each company (which will also depend on the lithium price and the capital and operational expenses incurred). In the company feasibility studies, the companies make assumptions regarding these values, which we assign to the “base case.”

One way in which we deviate from the companies’ assumptions is with the lithium price. We find that the companies assume lithium prices that are higher than they’ve been in the past, and higher than they’re expected to reach in the future. Rather than use these assumed values for the base case, we utilize lithium price forecasts prepared by SC Insights. The average lithium price over the project periods (2025–2047) is $21,000/tonne; by contrast, some companies expect average future prices of $30,000/tonne. It should be noted that the $21,000/tonne figure is a multi-year average, and that the SC Insights price curve includes prices ranging from about $30,000/tonne to about $17,000/tonne.

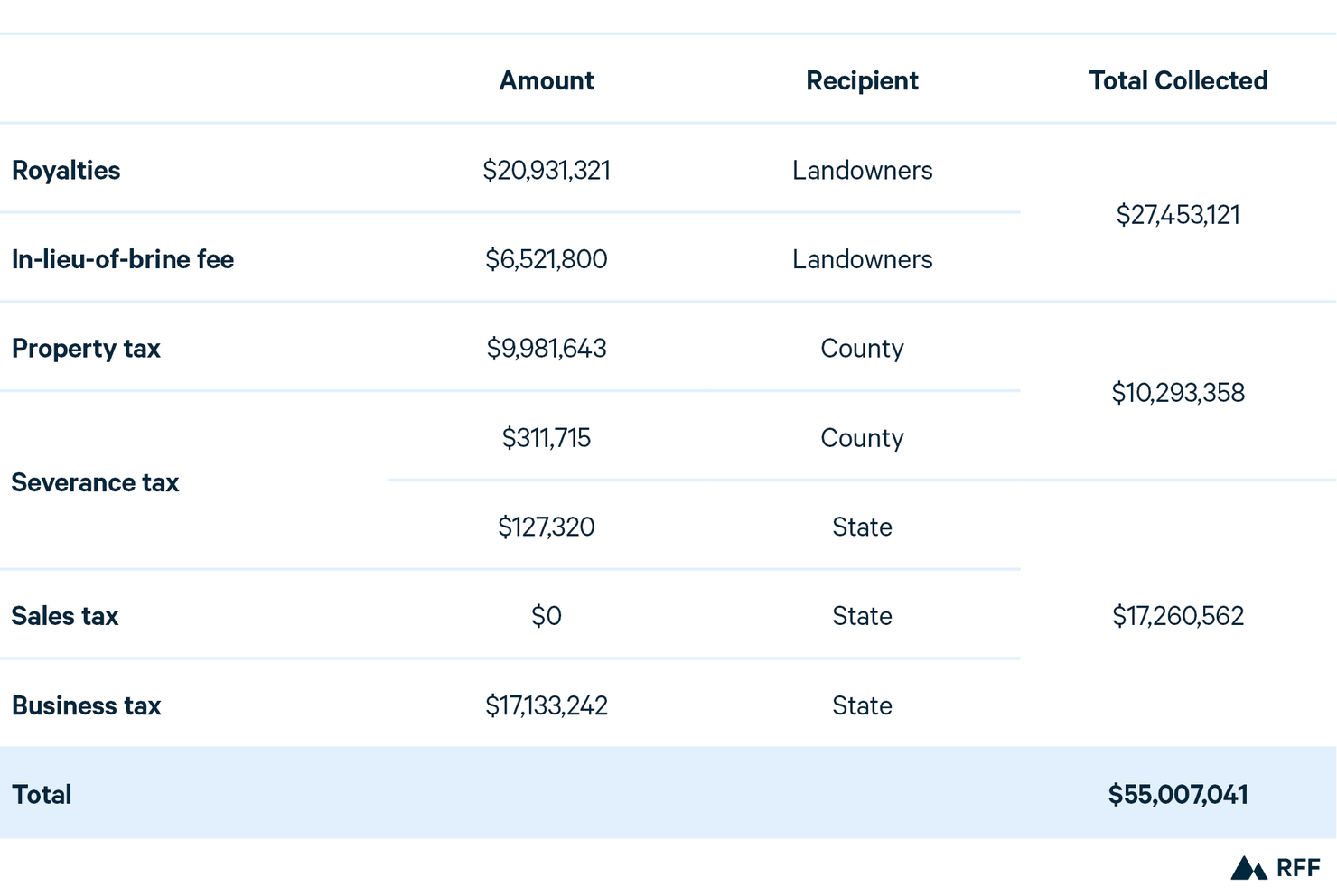

As can be seen from Table 2, if all goes as planned in company production, landowners end up collecting the largest amount of revenue per year. However, the amount of revenues that Lafayette, Columbia, and Union Counties collect in the base case exceeds 15 percent of their yearly budgets, providing an economically meaningful addition to the local coffers.

Table 2. Average Yearly Collected Revenues (Base Case for Southwest Arkansas)

Revenues Under Uncertainty

However, uncertainties in these projects abound. Part of the uncertainty is technical: Will the companies recover lithium as efficiently as expected? Will the project be delayed? Financial uncertainties also arise: Will the companies have cost overruns? Will lithium prices be as robust in the long run as expected?

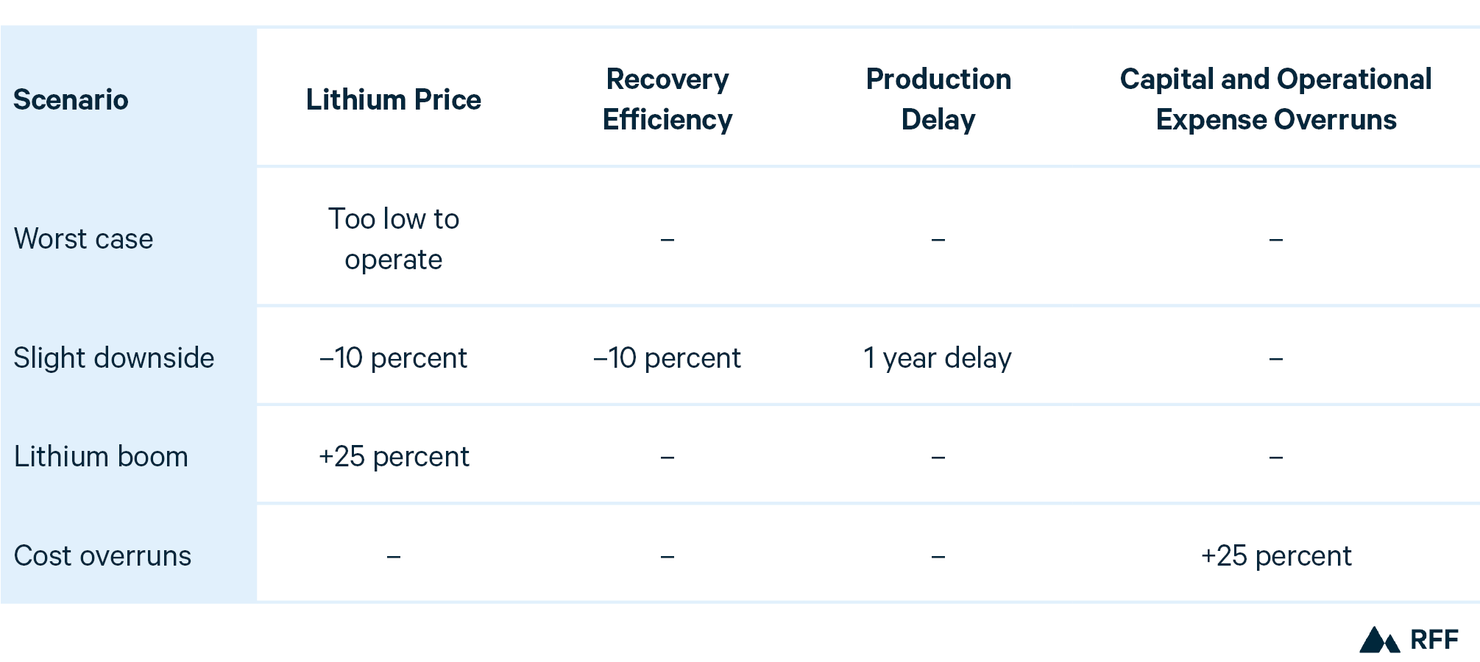

To address these questions, we estimate these collected revenues under four more scenarios, as described in Table 3.

Table 3. Four Lithium Revenue Scenarios

In the worst-case scenario, low lithium prices have led to companies simply not extracting lithium due to unprofitability. However, even if the companies are not extracting lithium, they still need to pay the in-lieu-of-brine fees to landowners (and maybe property taxes, depending on assessors’ discretion).

In the slight downside scenario, prices are 10 percent lower than the forecasts from SC Insights, the company recovery efficiency is 10 percent lower, and production is delayed by a year. In this case, company revenues are lower (due to lower sales and lower prices), thereby reducing contributions to most taxes and royalties; however, taxes related to the land coverage are not affected.

In the lithium-boom scenario, realized lithium prices are 25 percent higher than expected, perhaps because of a favorable purchase contract or due to global changes in supply and demand. In this case, company revenues go up, increasing how much the companies need to pay to landowners and government; however, property taxes and in-lieu-of-brine fees remain the same.

Finally, in the cost-overruns scenario, capital and operational expenses are 25 percent higher than expected. In this case, cost overruns would affect the property tax based on the estimated market value, which in turn is dependent upon the firm’s capital expenditures. Thus, when capital expenditures rise, so do the property taxes.

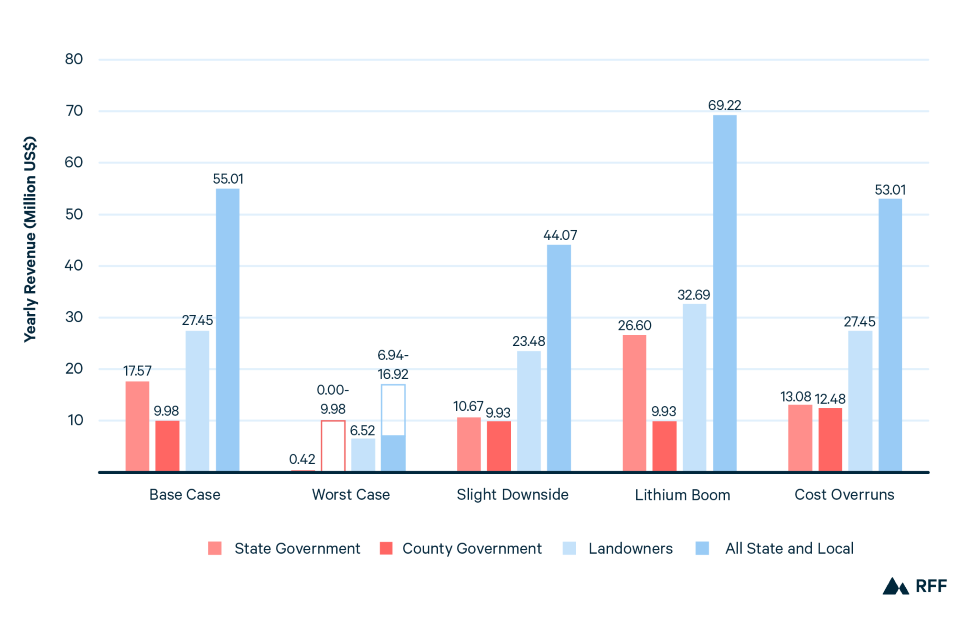

We find that even under the worst-case scenario, landowners would be paid over $6.5 million per year, though the county could miss out on revenues altogether, depending on assessors’ discretion (Figure 1). Interestingly, in the cost-overruns scenario, counties increase their tax collection by about 30 percent, while the state loses almost 40 percent of its collected revenues under the same scenario.

Figure 1. Yearly Revenues Collected by Landowners and Government from Lithium Extraction Under Different Scenarios for Southwest Arkansas

Notes: We provide a range of county revenues for the worst-case scenario, due to uncertainty about how property taxes would be assessed if company revenues dramatically decline. Arkansas property tax is based on assessed value, and assessors can reduce values when plants shut down or face financial distress.

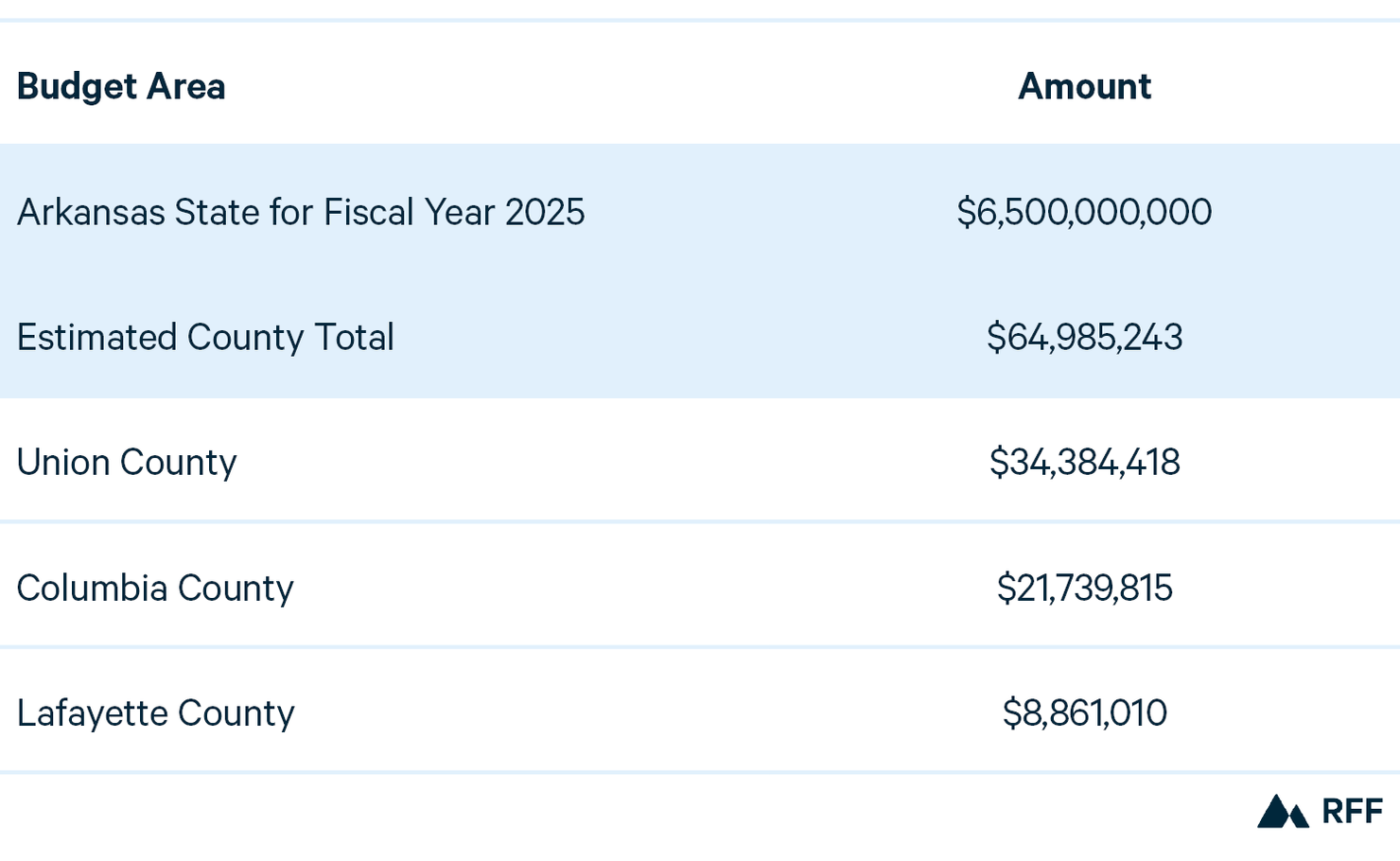

For comparison, note the following breakdown of state and county budgets in Arkansas shown in Table 4.

Table 4. Arkansas State and County Budgets

Next Steps for Policy

DLE could provide an opportunity for landowners and state and local governments to receive revenues through royalties and tax payments—revenues that could be used to fund roads, schools, and other services—yet the amount they could recover is uncertain. Future company profits and expenditures depend on a slew of variables, many of which are out of the control of both the government and companies.

If state and local governments want to ensure a steady stream of incoming revenues, policies can be structured to support these companies and reduce the uncertainties they face. However, the costs of such policies may be higher than the benefits that accrue to local or state governments. For example, in a new report, we find that a price floor to sustain production in unfavorable conditions could cost the federal government up to $10 billion. The government will have to decide whether the tax-revenue benefits and industrial policy goals achieved by this investment are worth these costs.

Editor’s Note: This blog post was updated on November 6 to accurately reflect how much landowners would be paid under the worst-case scenario. The text originally stated that landowners would earn $3 million.