If the administration’s push to increase US dependence on fossil fuel–powered electricity generation is implemented as intended, Then higher electricity rates and more uncertainty over future electricity prices are likely to emerge.

The administration has argued that removing barriers to coal and natural gas development is necessary to achieve and maintain affordable electricity. To that end, President Donald Trump issued the “Unleashing American Energy” executive order, which aims to expand fossil fuel resources and reduce barriers to fossil fuel production, with the stated intention of serving national interests and reducing household energy costs. These directives have been accompanied by ongoing efforts to strengthen the fossil fuel industry and repeal regulations and legislation that might hamper growth of the industry, including the clean electricity tax credits in the Inflation Reduction Act (IRA) and the carbon pollution standards established by the US Environmental Protection Agency (EPA).

However, RFF-produced evidence suggests that electricity prices will be higher and subject to more uncertainty as a result of the administration’s promotion of fossil fuels at the expense of solar and wind energy.

The Prices: Clean Energy and Electricity

Many studies show that decarbonizing the electric grid, and the policies that support this aim, can reduce electricity costs. Modeling efforts leading up to the passage of the IRA found that production and investment tax credits incentivizing clean energy investment would reduce wholesale and retail electricity rates, relative to a baseline. Leading up to the passage of the 2025 One Big Beautiful Bill Act (OBBBA), another set of studies showed that repealing the tax credits would increase electricity bills for consumers. These analyses project that households could face up to $400 more on their electricity bills per year, with estimates varying by study and by region. Some of the variation in these results can be explained by varying demand and differences in natural gas prices, factors that are major drivers of electricity system outcomes.

The Volatility: Fossil Fuel Prices

For many households, the stability and predictability of energy costs are key components of affordability. Significant cost fluctuations (i.e., volatility) often are passed through to consumers, resulting in higher rates and less ability to anticipate energy expenses (i.e., price uncertainty). Spikes in energy prices and utility bills can cause financial strain for households that rely on stable costs to plan and manage their budgets. Price uncertainty also is widely understood to delay business investment, even when the expected value of an investment is positive.

Fossil fuel generators and renewable energy resources are subject to unique factors that impact electricity prices. Fossil fuel generators are exposed to coal and natural gas prices, which are subject to the volatility of global markets. Because natural gas historically has set the price in electricity markets, fluctuations in the cost of natural gas can drive significant changes in power system costs.

Evidence of fossil fuel assets driving price increases has been found empirically in retail prices, as well. A 2024 report on power price spikes notes that states with higher shares of natural gas generation experienced larger increases in retail electricity rates between 2020 and 2023—years with high natural gas prices.

Conversely, renewable energies such as wind, solar, and storage projects require large up-front investment and are subject to uncertainty in capital costs. But, once built, renewables are much more insulated from volatility in global commodity prices.

In a previous Resources for the Future (RFF) report, our colleagues analyzed cost uncertainties for fossil and renewable assets. The study found that an all-renewable portfolio had lower cost uncertainty than an all-fossil portfolio, and including renewable assets in an all-fossil portfolio decreased uncertainty more than including fossil assets in an all-renewable portfolio.

Policy Impacts: Uncertain Electricity Prices

These studies suggest that the administration’s emphasis on fossil fuels would amplify exposure to volatile fuel markets, actually increasing uncertainty in electricity pricing.

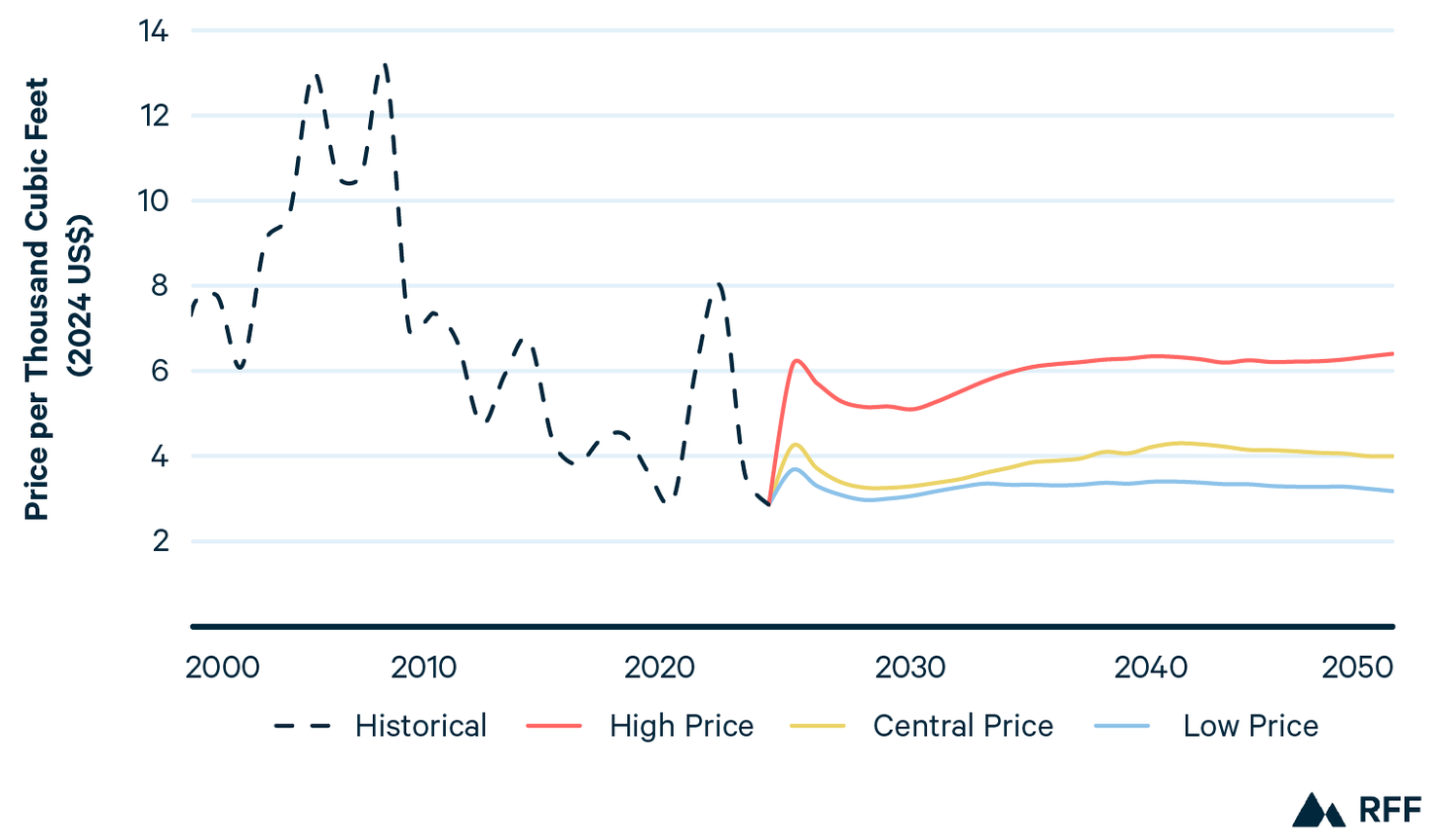

To test this idea, we used Haiku, an RFF model that simulates the power sector and projects how a fossil energy future would impact electricity prices. We simulated the US power grid under two different policy scenarios: (1) under both the IRA clean energy tax credits and EPA’s carbon pollution standards and (2) under the OBBBA revisions to clean energy tax credits without EPA’s carbon pollution standards—and compared the wholesale electricity prices in both scenarios when subjected to three price paths for natural gas. The three price paths are shown in Figure 1, along with historical natural gas prices, to highlight the volatility of these prices in recent years.

Figure 1. Historical and Projected Price Paths for Natural Gas

Sources: Annual Energy Outlook 2023 and US Natural Gas Electric Power Price (inflation adjusted using GDP Deflator) from the US Energy Information Administration. Notes: The price paths for natural gas do not exhibit the volatility seen in historical prices because models typically are designed to capture long-term structural trends and exclude short-term shocks (such as extreme weather events or geopolitical disruptions) that drive real-world price fluctuations.

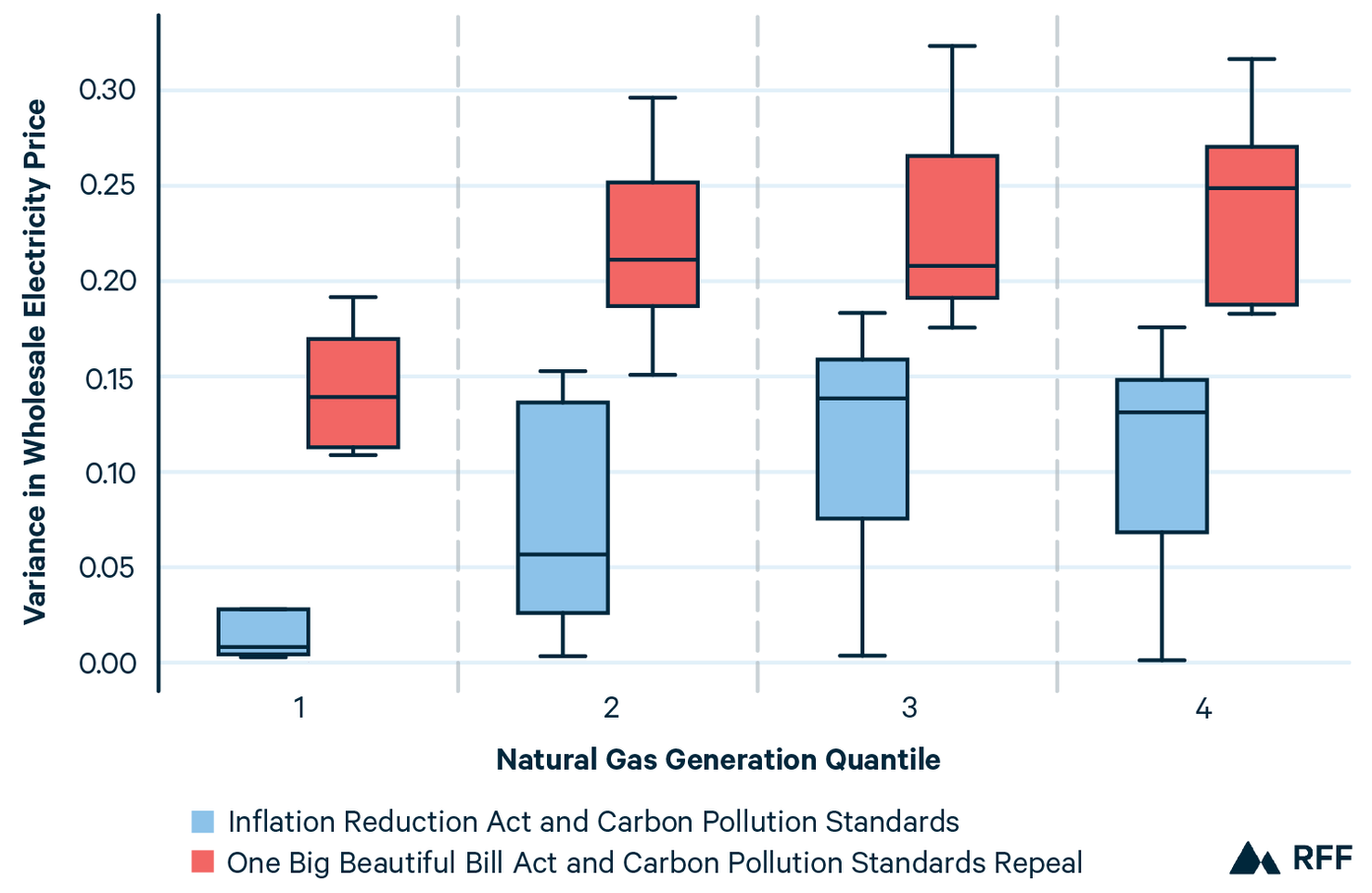

For each US state, we calculated the normalized variance (a measure of how widely a set of numbers ranges) in projected wholesale electricity prices, averaged from 2030 to 2040, under the three price paths for natural gas.

The box-and-whisker plots in Figure 2 show the distribution of the calculated state-level variances. For each box plot, the center line indicates the median variance for the wholesale electricity price of all states in a given quantile, and the box itself represents the middle 50 percent of variances (i.e., from the 25th to the 75th percentile). States that are least reliant on natural gas for electricity generation are classified in Quantile 1, while states that are most reliant on natural gas are in Quantile 4. In Scenario 1 (shown in blue), the IRA’s clean energy tax credits and EPA’s carbon regulations incentivize investment in renewable technologies, driving a shift away from high-emission fossil generators. In contrast, Scenario 2 (shown in red) shows OBBBA’s removal of the tax credits for renewables and repeals EPA’s regulations on natural gas and coal plants.

Figure 2. State-Level Variance in Wholesale Electricity Prices Under Three Natural Gas Price Sensitivities (Averages for 2030–2040)

Note: Some state-level outliers in the variance measurements have been omitted from the plots.

The results show that, generally, states with less natural gas generation have lower electricity price variance, while states with higher fractions of natural gas generation have higher price variance. In the clean energy scenario (Scenario 1 in blue), the states with the lowest fraction of natural gas generation have a median price variance of 0.01, compared to a median price variance of 0.13 for states with high natural gas generation.

Figure 2 also shows that a fossil fuel energy future, without clean production tax credits or emissions regulations, has higher price variance overall. Lower price variance in the clean energy scenario suggests that investing in renewable energy can shield customers from the volatility of fossil fuel prices.

In the OBBBA scenario (Scenario 2), we assume wind and solar projects that come online in or before the year 2029 will receive the IRA’s clean energy production tax credits. A lot of uncertainty still surrounds the implementation of the OBBBA—including the foreign entity of concern provision and commence construction rule—and forthcoming guidance from the US Department of the Treasury may be more restrictive than our representation. An OBBBA scenario with less renewable build-out due to more stringent rules, for example, likely would project increased variability of electricity prices.

Altogether, these analyses suggest that a policy approach that emphasizes fossil fuel build-out increases retail electricity rates and the uncertainty of electricity costs, relative to a grid with expanded renewable generation. A grid with higher fractions of low-cost, renewable resources leads to lower prices relative to a fossil fuel energy future, according to studies cited in this analysis. Volatile fossil fuel prices have been shown to drive increases in electricity prices, and exposing customers to fluctuating costs likely will raise electricity bills as utilities recoup their expenses in the context of heightened uncertainty. Further, decisions by utilities to delay investments or hedge against risks in the face of uncertainty can add additional costs for consumers.

To that end, clean energy tax credits and federal regulations placed on fossil fuel resources are not inherently in conflict with the administration’s goal of affordable electricity, as opposed to a reversal of EPA’s carbon pollution standards and IRA clean energy tax credits. Ultimately, the intended strategy is likely to expose customers to the volatility of fossil fuel markets, resulting in higher, more unpredictable electricity prices.

A Note on Our Methodology

The version of Haiku used in this analysis is most similar to the model used in the 2023 Carbon Scoring Project with updated demand from the US Energy Information Administration’s Annual Energy Outlook (AEO) 2025 report. Information on how IRA tax credits are implemented in Haiku can be found here and here. Our representation of EPA’s carbon pollution standards follows the approach that’s outlined in this study. We encourage readers to reach out to the authors for further details about the modeling methods we used for this analysis.

For more timely insights about developments in environmental and energy policy, browse the If/Then series.