The Regional Greenhouse Gas Initiative recently performed its third review of the program, leading to recommended updates. This milestone reaffirms the regional carbon market, which may entice other states to align with the effort.

The 10 states currently participating in the Regional Greenhouse Gas Initiative (RGGI), which regulates carbon dioxide emissions in the electricity sector of the mid-Atlantic and Northeastern United States, completed their third program review this month with adjustments that strengthen the regional cap-and-invest program. The suggested adjustments to update the program emphasize energy affordability and putting the states on course to achieve state clean electricity goals. Perhaps most importantly, the reaffirmation of the regional carbon market provides stability for planning and investments at a time of great uncertainty for other elements of the economy and energy policy.

The next step in implementing the recommendations from this update will involve state actions to update their respective laws, a process that’s expected to be completed by 2027.

The states in RGGI have seen emissions fall by roughly half since RGGI launched as the first carbon market in North America in 2009. Each state auctions the allowances under its state emissions cap, with auction proceeds directed largely to strategic energy investments and bill relief for ratepayers.

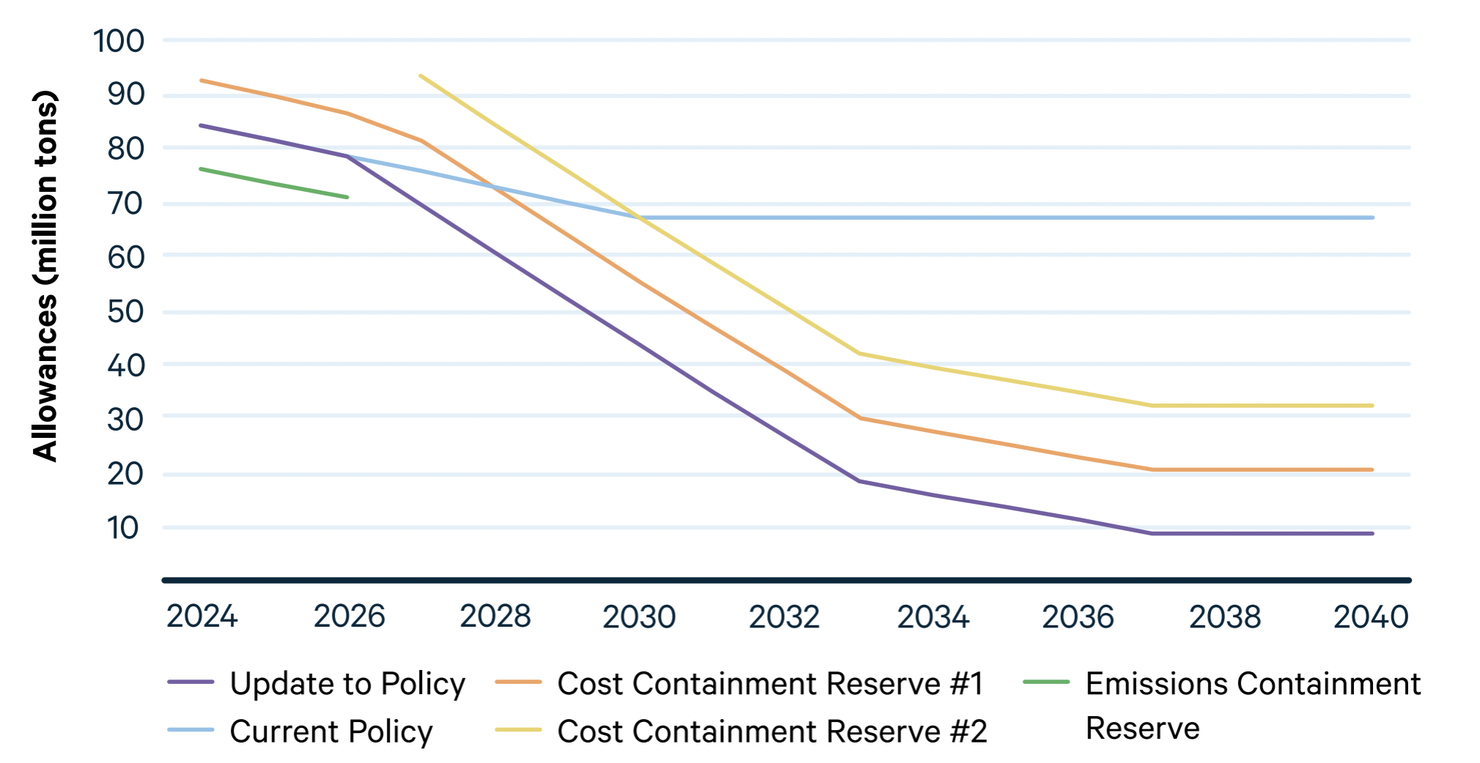

Adjustments to the emissions caps approach, but stop short of, meeting state goals that aim to fully decarbonize the electricity sector by 2035 or 2040, depending on the state. The states are planning a fourth RGGI program review beginning in 2028, at which time they can revisit the potential for deeper emissions reductions. Figure 1 depicts the new cap trajectory as the line labeled “Update to Policy.”

Figure 1. Trajectory of Emissions Cap Over Time for the Regional Greenhouse Gas Initiative

Note: Current privately held banked allowances are not shown.

Under the program update, the cap will be reduced to 70 million tons in 2027. Emissions allowances can be banked (saved) for use in subsequent years. The prior declining emissions trend has enabled the bank of privately held allowances to accumulate to about 67 million tons, nearly equal to the current annual cap of about 80 million tons.

In previous program reviews, RGGI has implemented a “bank adjustment” by sharply reducing the allowance cap over a period of four to five years to absorb privately held allowances and strengthen the market. While no bank adjustment is planned this time, the new steeper cap trajectory is designed to both absorb the substantial allowance bank and put the states on a course to decarbonize the sector. Emissions offsets, which have been used only rarely previously, will no longer be eligible.

The supply of emissions allowances in the RGGI market is designed to dynamically respond to allowance prices. The update, which takes effect in 2027, will raise the auction price floor to $9, replacing the existing emissions containment reserve. No allowances will sell at a price below this level. If the auction price rises to tier 1 of the cost containment reserve (CCR), set at $19.50, then 11.75 million additional allowances become available each year. The update adds an equal tranche of allowances that becomes available at tier 2 of the CCR if the price rises to $29.25. These prices rise by 7 percent annually. The current RGGI policy and updates to the policy, including the CCR provisions, are illustrated in Figure 1.

Modeling by RGGI shows that strengthening the program will not raise electricity prices. Similar previous modeling by Resources for the Future has shown the same result.

Energy affordability for ratepayers is affected in three ways through RGGI. One is that renewable energy has lower life-cycle costs and lower marginal costs than fossil fuel–fired generators in the power market. The carbon price provides the incentive to overcome the up-front investment hurdle for renewable energy, and consumers tend to benefit in the long run.

Second, the major share of auction proceeds has been directed to energy efficiency investments. This report from Analysis Group describes the effectiveness of those investments. If someone is the recipient of those incentives, that’s great—but overall, the market benefits from the reduced demand that in turn reduces the allowance price.

Third, some states have on-bill rebates that often target low-income ratepayers.

RGGI is a modest program affecting only the electricity sector, but it has punched above its weight in providing innovations in market design, including the introduction of an auction with a price floor at its outset in 2009, regular program reviews to maintain and enhance the program, and market rules that dynamically adjust the allowance supply at different price levels. These features combine to limit the increase in emissions on the one hand, or change in allowance prices on the other hand, that may result from changes in technology, changes in economic conditions, or the success of other regulations that can affect the carbon market.

The RGGI program update provides an elegant model and demonstrates the continuing success of a cooperative multi-state process that may entice other states to align with or join the cap-and-invest program.

For more timely insights about developments in environmental and energy policy, browse the If/Then series.