Traditionally, the value created from pricing pollution has been directed to the regulated industry, an approach called “grandfathering.” However, there has been a growing trend, especially when pricing carbon emissions, toward auctioning emissions permits and the direct payment of emissions fees. These approaches are more consistent with the polluter pays principle and cast carbon revenues as payments for environmental services from the polluting firms to the owner of the atmosphere resource.

Requiring polluters to pay generates revenue, which leads to two fundamental questions. First, who is the owner of the atmosphere resource and thus to whom should the payment accrue? Second, should efficiency or procedural fairness be the primary consideration in deciding how to use carbon revenue? The second question is relevant from a policy design standpoint because greenhouse gas emissions are ubiquitous and their mitigation will be expensive, requiring a successful climate change policy to be both practical and politically feasible.

In a recent paper we discuss these questions in the context of prior and existing environmental policy. We describe the historical trend away from grandfathering toward revenue raising auctions and fees, the revenues of which are largely invested based on the “polluter pays” principle.

While the existing literature has focused on the best means of revenue collection and form of revenue expenditure, the more fundamental philosophical underpinning has been largely overlooked. Identifying the state as the owner of the atmosphere resource implies that the carbon asset value is like any other government revenue, which can be utilized to solve the government’s fiscal or planning problem. If citizens collectively are the owner, then the carbon asset value belongs to the collection of individuals. In this case the government’s utilization of that value to solve its planning problem might be viewed as a taking essentially equivalent to confiscating other property for the same purpose.

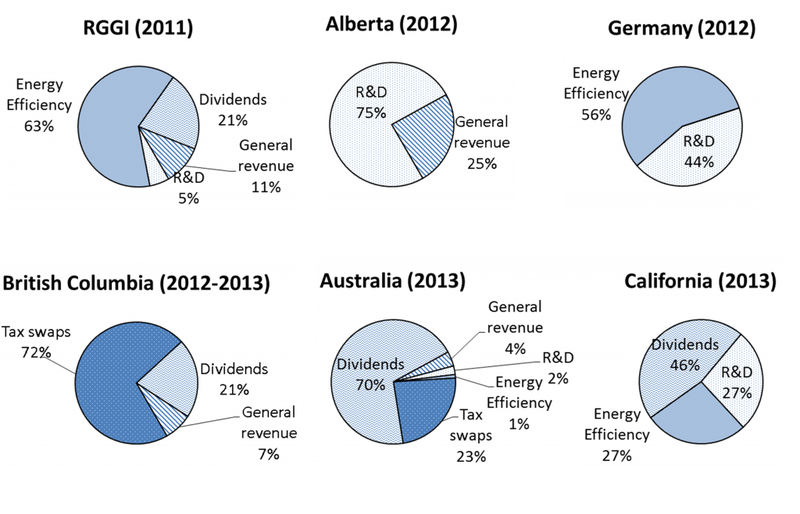

We also evaluate the payments for environmental services from a policy design perspective in existing climate policy in six different countries and regions. We determine five payment categories: investment in research and development, investment in energy efficiency, replacement of other taxes with a carbon tax (tax swaps), return of revenue to citizenry on a lump-sum basis (dividends), and the use of carbon asset value as general revenue. Tax swaps and general revenue are associated with a state-owned atmosphere resource. In contrast, dividends clearly are associated with a commonly held atmosphere resource.

We find that British Columbia and Australia, which both have a carbon tax, employ tax swaps to offset a substantial portion of their revenues and—along with the Regional Greenhouse Gas Initiative (RGGI) and California—return a portion of their revenues to citizens, especially low-income individuals. The most common forms of revenue-use are investments in energy efficiency and renewable energy projects, which are designed by the government but benefit energy consumers (common property owners). Each form of expenditure has its merits and concerns in terms of economic efficiency, political feasibility, transparency, and ability to further the policy’s effectiveness in climate change mitigation, which are considered in the paper.

Ultimately, the only philosophy certainly embraced among all the carbon-pricing schemes—to varying degrees but generally on the ascent—is the polluter pays principle. This philosophy has created an associated increase in carbon revenue. The resulting question we examine is: To whom should this value accrue? Practice in existing programs has resulted in numerous forms of revenue expenditure across the globe, leading to varying efficiency and socio-political outcomes.